(Zero Hedge)—Arabica coffee futures surged to record highs on Friday, fueled by the ongoing global supply crunch. The most-active contract climbed nearly 2% in late morning trading, reaching the highest price levels on record dating back to 1972. The multi-year parabolic move in coffee prices only suggests higher Starbucks and/or supermarket market prices in the months ahead if hedges fail to offset bean inflation.

The big price jump has traders reducing their exposure to the futures market due to elevated costs, making the market more prone to volatility.

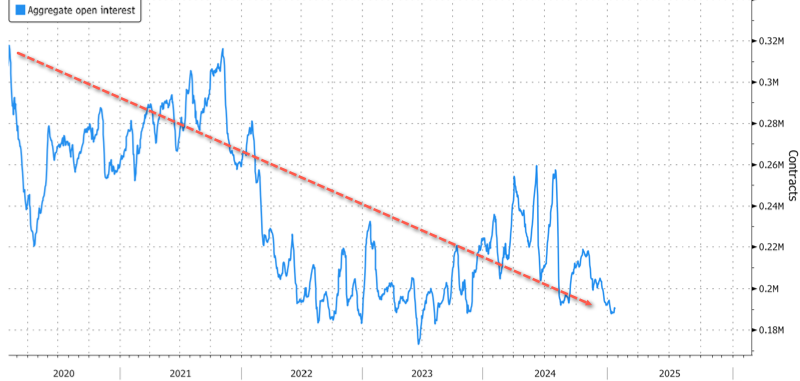

Bloomberg data shows aggregate open interest — or the number of outstanding contracts — has declined in the past five years while prices moved higher.

Bloomberg’s Dayanne Sousa and Mumbi Gitau provided readers with bean supply concerns coming out of top grower Brazil:

After record shipments in 2024, Brazil should see a slowdown ahead “mainly due to the next arabica crop likely being smaller,” analysts at Itau BBA bank wrote in a report.

That’s a concern in a period when global stockpiles remain tight. The fact that previously strong exports from Brazil weren’t enough to replenish world inventories “shows that demand has not yet allowed there to be an excess of coffee on the market,” said broker Thiago Cazarini, president of Cazarini Trading Co.

Another reminder of the tightness in global supplies was this week’s decline in bean stockpiles held at exchange- monitored warehouses. That could indicate “robust spot demand in Europe,” said Tomas Araujo, a trading associate at StoneX.

In a separate note, Bloomberg’s Ilena Peng and Mumbi Gitau said:

Prices have been boosted by concerns about the output in top producer Brazil, where a drought reduced the potential production for the upcoming season. The decline in certified arabica stockpiles held at exchange-monitored warehouses this week is another reminder of continuing supply concerns. The surge is causing nervousness among coffee buyers already faced with tight global inventories and supply chain constraints, said Tomas Araujo, a trading associate at StoneX

The bean surge should not only make commercial coffee buyers nervous but also leave consumers uneasy, as there are no indications that global food inflation will ease in the first quarter of 2025.

Don’t just survive — THRIVE! Prepper All-Naturals has freeze-dried steaks for long-term storage. Don’t wait for food shortages to get worse. Stock up today. Use promo code “jdr” at checkout for 35% off!

What Would You Do If Pharmacies Couldn’t Provide You With Crucial Medications or Antibiotics?

The medication supply chain from China and India is more fragile than ever since Covid. The US is not equipped to handle our pharmaceutical needs. We’ve already seen shortages with antibiotics and other medications in recent months and pharmaceutical challenges are becoming more frequent today.

Our partners at Jase Medical offer a simple solution for Americans to be prepared in case things go south. Their “Jase Case” gives Americans emergency antibiotics they can store away while their “Jase Daily” offers a wide array of prescription drugs to treat the ailments most common to Americans.

They do this through a process that embraces medical freedom. Their secure online form allows board-certified physicians to prescribe the needed drugs. They are then delivered directly to the customer from their pharmacy network. The physicians are available to answer treatment related questions.