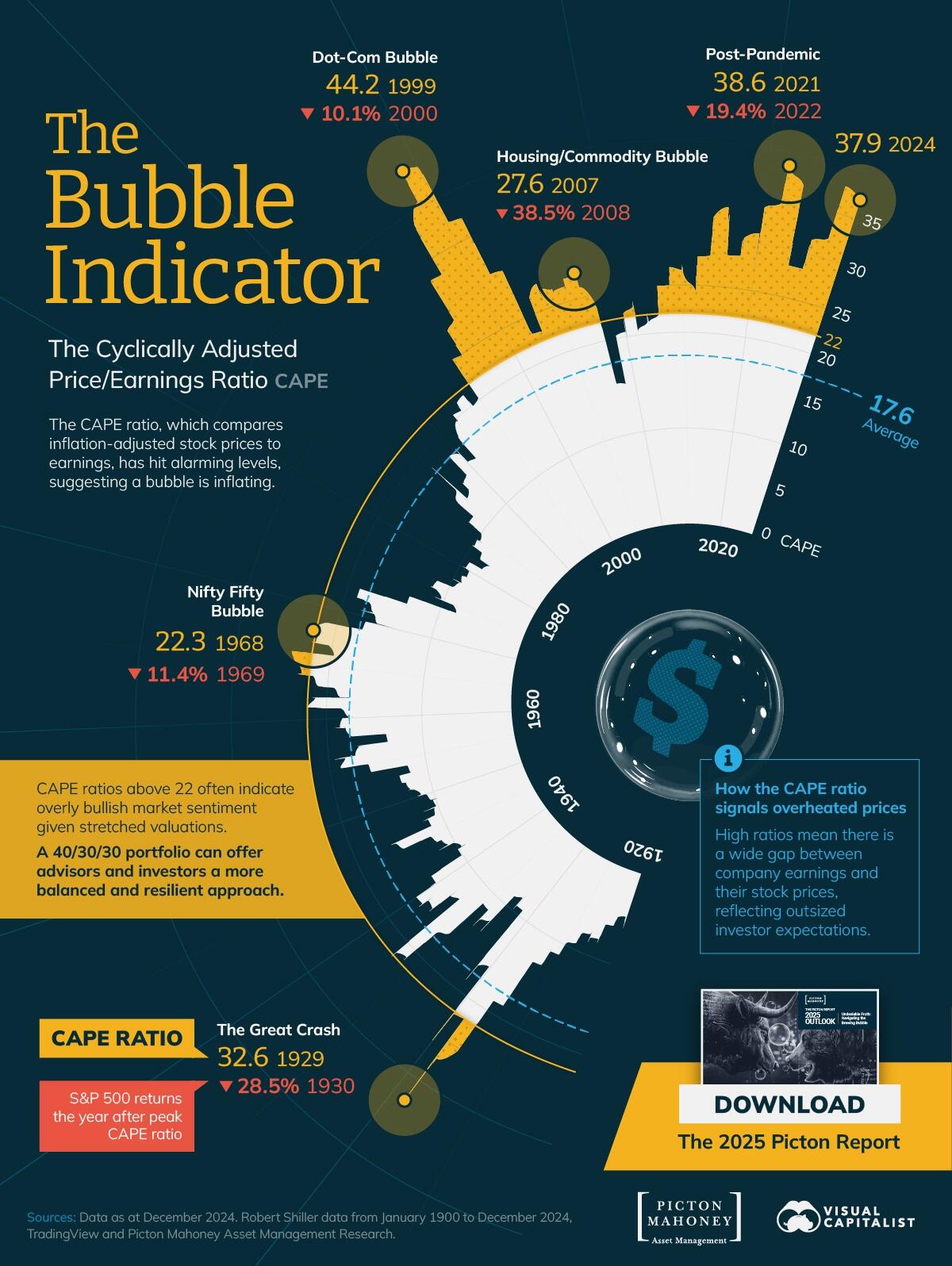

(Zero Hedge)—Today, the S&P 500’s cyclically adjusted price-to-earnings ratio (CAPE) is nearing historic highs, signaling market valuations may be in overheated territory.

In December 2024, the S&P 500 CAPE ratio stood at 37.9 – well above its long-term average of 17.6. Notably, it has only exceeded this level during the Dot-Com bubble and in 2021.

As Visual Capitalist’s Dorothy Neufeld shows in this graphic from Picton Mahoney Asset Management shows the S&P 500 CAPE ratio since 1920.

The S&P 500 CAPE Ratio Across Major Bubbles

The CAPE ratio is a widely used metric for assessing stock market valuations, comparing equity prices to their 10-year average earnings.

By smoothing out short-term fluctuations, it accounts for economic cycles and offers a more stable view of long-term value. Higher CAPE levels often signal stretched valuations, with historical trends showing that ratios above 22 typically indicate heightened market optimism.

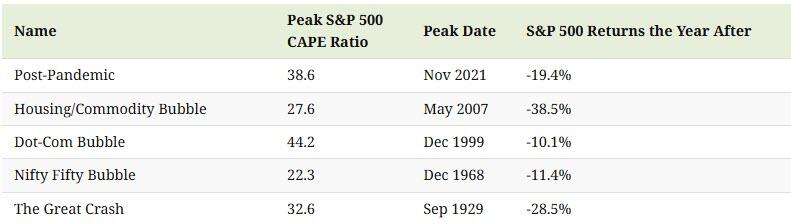

Here are the peak CAPE ratios during major market bubbles over the past century:

The CAPE ratio hit an all-time high during the Dot-Com bubble in 1999, which was followed by a 40% decline in the S&P 500 from 2000 to 2002.

More recently, the ratio climbed to 38.6 in 2021, its second-highest reading ever, fueled by massive pandemic stimulus and a big tech rally. The following year, the S&P 500 sank 19.4% as the Federal Reserve kicked off its monetary tightening cycle.

Similarly, the CAPE ratio has risen sharply as AI enthusiasm—particularly for Magnificent Seven stocks—has led stock prices to soar, making stock prices expensive by historical standards.

Diversification Strategies for Market Bubbles

At a time of outsized investor expectations, a more balanced portfolio allocation may reduce exposure to market bubble risk.

Investors and advisors can implement Picton Mahoney Asset Management’s Innovative Portfolio, which offers a strategic 40/30/30 mix of equities, bonds, and alternatives to hedge against a potential asset bubble.

What Would You Do If Pharmacies Couldn’t Provide You With Crucial Medications or Antibiotics?

The medication supply chain from China and India is more fragile than ever since Covid. The US is not equipped to handle our pharmaceutical needs. We’ve already seen shortages with antibiotics and other medications in recent months and pharmaceutical challenges are becoming more frequent today.

Our partners at Jase Medical offer a simple solution for Americans to be prepared in case things go south. Their “Jase Case” gives Americans emergency antibiotics they can store away while their “Jase Daily” offers a wide array of prescription drugs to treat the ailments most common to Americans.

They do this through a process that embraces medical freedom. Their secure online form allows board-certified physicians to prescribe the needed drugs. They are then delivered directly to the customer from their pharmacy network. The physicians are available to answer treatment related questions.