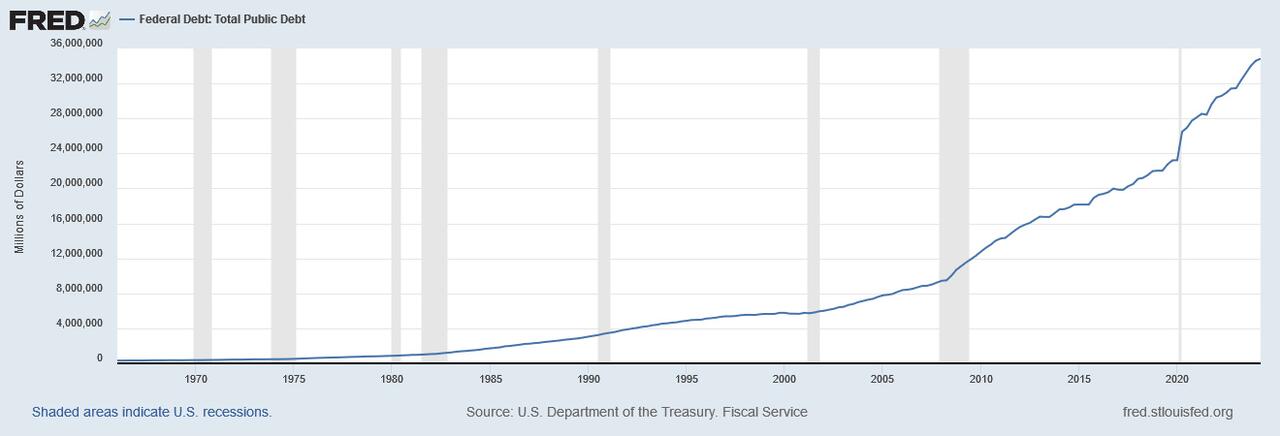

(Zero Hedge)—With soaring deficits, soaring debt, and interest payments that can only be made by issuing a debt-based currency on which even more interest will be due, the USD can only possibly be described as an elaborate nation-state level bankster Ponzi scheme.

Dollars are backed by debt, which requires infinite economic growth to service.

Without constant inflation to erode the debt’s value, transferring wealth from savers to the government and bankers, it all falls apart.

Without new borrowers to sustain current spending, it all falls apart.

Without a petrodollar system where the USD is no longer the world reserve currency, and other countries no longer are forced at gunpoint to use dollars, it all falls apart.

Just as a Ponzi scheme collapses when enough investors lose confidence in it, because there’s no underlying value and not enough new suckers to pay back previous waves of investors, the USD collapses under the same scenario.

And while I see the surface-level, superficial appeal of president-elect Donald Trump’s plan to replace the income tax with tariffs, there’s (at least) one very big problem. We’re in a country that, for decades, hasn’t had a manufacturing base, making the economic viability of the plan incredibly questionable. Even if it somehow worked, it wouldn’t solve the problem of the world’s largest economies being based on glorified, state-sanctioned Ponzi schemes.

Until we revert back to dollars that are pegged to something of real value, like gold, the scam will continue. And it’s gone on for so long that tremendous economic pain is now a prerequisite for weaning ourselves off of it. Just as a Ponzi scheme collapsing harms everyone unlucky enough to be involved, the unwinding of the petrodollar USD Ponzi will hurt every American and, indeed, people all around the world as it reels under the chaos of the realization that the dollar was hollow all along, and the line of new suckers to buy US debt has officially dried up.

With 10-year Treasury yields rising and major pressure on interest rates to go higher, the Fed and Trump are desperate to keep them low. But at $35 trillion, our debt bomb isn’t going away, and the deficit isn’t going anywhere. A heavier interest payment burden and QE are going to blow the USD Ponzi balloon bigger and bigger, so the only question will be when it pops.

Painful as the explosion will be, it’s unavoidable and necessary, and will only be more severe the longer the Ponzi goes on. Just as more investors get hurt, and more spectacularly so, when a Ponzi is able to grow larger, the US dollar collapse will be more painful the longer the can is kicked down the road. This reset will be an opportunity to go back to sound money, but as in the 2008 crisis, the same elites that caused it will try to exploit it as an opportunity to implement an increasingly centralized system that gives them even more control.

Unfortunately, we’re past the event horizon for the Ponzi. Past the point of no return. No amount of economic tinkering, even of the right sort and on a big-enough scale, from Trump or anyone else, can reverse or solve the problem without a major implosion causing terrible pain across the economy. Gold is one way to protect yourself from the fallout, but when it comes crashing down, no one will be immune to the effects of such a spectacular burst.

What Would You Do If Pharmacies Couldn’t Provide You With Crucial Medications or Antibiotics?

The medication supply chain from China and India is more fragile than ever since Covid. The US is not equipped to handle our pharmaceutical needs. We’ve already seen shortages with antibiotics and other medications in recent months and pharmaceutical challenges are becoming more frequent today.

Our partners at Jase Medical offer a simple solution for Americans to be prepared in case things go south. Their “Jase Case” gives Americans emergency antibiotics they can store away while their “Jase Daily” offers a wide array of prescription drugs to treat the ailments most common to Americans.

They do this through a process that embraces medical freedom. Their secure online form allows board-certified physicians to prescribe the needed drugs. They are then delivered directly to the customer from their pharmacy network. The physicians are available to answer treatment related questions.